In a

previous blog entry, I was experimenting with a different way of measuring the market breadth. I also posted that on an Investools forum, and another more experienced trader replied and asked:

- Have you compared your chart to a chart of a broad index such as the the SPX or OEX? How different is it?

- Could you gain the same info by looking at the strength of the trend on the indexes?

It got me thinking about this more, and below is the response I posted on that forum.

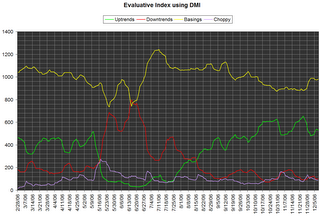

SPX and OEX are capitalization-weighted, but my chart doesn't take market cap into account. Every stock gets one vote toward the final count of uptrends, downtrends, and trading ranges. It seems similar to the trade-offs between cap-weighted vs. equal-weighted indexes. The information is related but not identical.

When looking at the trend strength on the indexes, the information you get depends a lot on how you determine trend strength. If you use ADX(14,14) with a threshold of >=25 to mean "trend exists", ADX confirmed the summer 2006 SPX uptrend on Sept 5. But if you use MA crossovers, such as the 10-20-30-50 EMA "ribbon" (where increasing space between the MAs means increasing strength), the ribbon confirmed uptrend on Aug 15 -- 3 weeks earlier than ADX, and it coincided with a resistance breakout. But, the ribbon isn't always earlier than ADX. For the May 2006 correction, ADX confirmed the downtrend two days before the ribbon did. (And BTW, 3 red arrows came even earlier, a full week before ADX - so it pays to remember the basic Investools method!) So both of these approaches seem like good techniques for measuring trend, and once they agree, trend-following techniques should really work - i.e. these are great ways to gauge market sentiment.

My chart is a different angle on the market trend. Are just a few companies driving the index move or many companies? How many companies are still in trading ranges? Is an upward move due more to an increasing number of uptrends or a decreasing number of downtrends? For example, the SPX had a brief upward swing at the end of June 2006. On the SPX daily chart, you see ADX falling, indicating decreasing trend strength. On my chart you can see it was due to a sharp drop in the number of downtrends; the number of uptrends did not increase significantly yet. So, this upward swing didn't have much oomph behind it for the bulls, but the sharp decline in number of downtrends was also a warning for the bears, even though the SPX did make a lower high.

Well, I'm still experimenting with this kind of market breadth indicator. Not sure yet if I can use this chart to trade profitably, because looking at the SPX chart really is much simpler. :) But it does seem to offer some useful insight when a trend reversal may be unfolding. I'm certainly curious to see what it has to say about the upcoming market top that everyone keeps talking about. Dec 14 was a nice strong day for SPX, but on my chart, the number of uptrends was actually slighly down. Hmmmmm.....