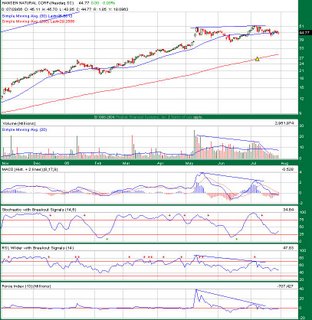

HANS - Bearish Divergence

I just noticed today that HANS started trading options on Monday this week! I haven't really been following HANS, but now that it has options, maybe I should. Here's what the HANS chart looks like today:

The MACD (in 2-lines mode), RSI, and Force Index are all showing significantly lower highs at the same time that the HANS stock price is making slightly higher highs, but on lower volume. HANS earnings are coming up some time in mid-August (an exact date doesn't seem to have been announced yet), but "advance" quarterly GDP numbers came in below expectations today. Could that foreshadow an earnings shortfall for HANS? But then again, Coke (KO) and Pepsi (PEP) beat the street's earnings estimates by a few cents per share this past quarter. For HANS, the negative divergence in the technical indicators is most concerning.

The MACD (in 2-lines mode), RSI, and Force Index are all showing significantly lower highs at the same time that the HANS stock price is making slightly higher highs, but on lower volume. HANS earnings are coming up some time in mid-August (an exact date doesn't seem to have been announced yet), but "advance" quarterly GDP numbers came in below expectations today. Could that foreshadow an earnings shortfall for HANS? But then again, Coke (KO) and Pepsi (PEP) beat the street's earnings estimates by a few cents per share this past quarter. For HANS, the negative divergence in the technical indicators is most concerning.I'd consider buying puts on HANS, but the bid-ask spread is super huge right now -- I guess the options are so new that there isn't the liquidity yet. But I'll definitely be watching this one a lot more closely now.